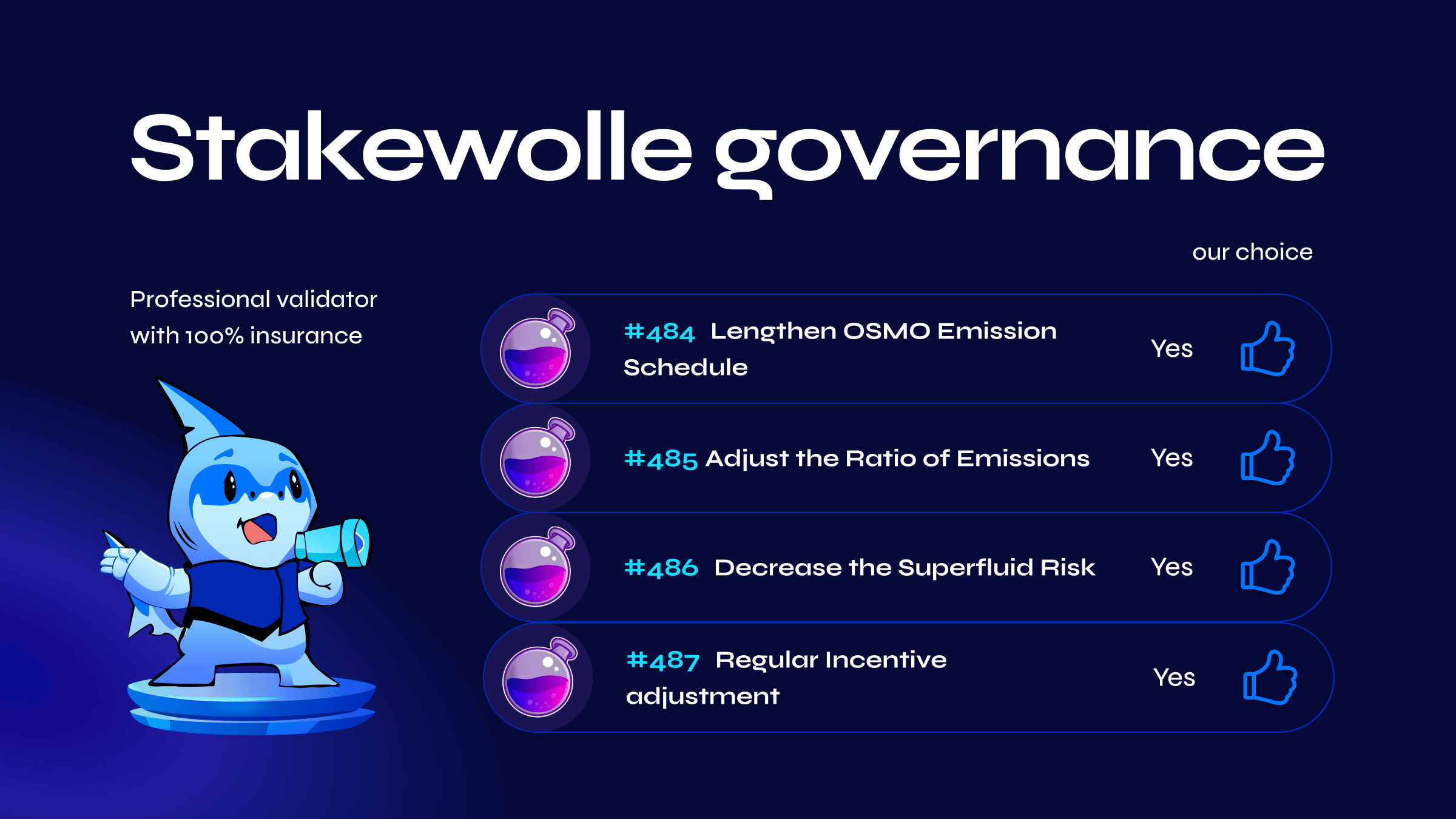

Stakewolle Governance 18.04

18 Apr 2023

1 min read

Stakewollve votes Yes on Osmosis proposals #484, #485, #486, and #487. A set of proposals #484, #485, and #486 will change Osmosis Tokenomics. Tokenomics needed to be changed due to problems such as:

• Inflation is higher than the reward earned for staking.

• Inflation is higher than the reward received for providing liquidity in larger pools.

• The community pool has been receiving redirected incentive emissions for the last 10 months.

• Superfluid staking is underutilized as a flagship product of Osmosis

Those proposals will implement next changes:

• Inflation on Osmosis will fall from ~36% to ~18% but decrease more slowly after this June.

• Staking APR will dip slightly from ~22% to ~20%, but move from a net yield of ~-4% to ~+7%.

• Typical Liquidity APR will dip slightly from ~26% to ~24%, but move from a net yield of ~9% to ~11%.

• Superfluid Staking will become more prominent with Liquidity Providers gaining a higher proportion of their rewards as well as additional voting power from this.

• Community Pool growth will drastically reduce.

• Developer Rewards will decrease in line with the inflation reduction.

Proposal #487 is proposal for regular Incentive adjustment