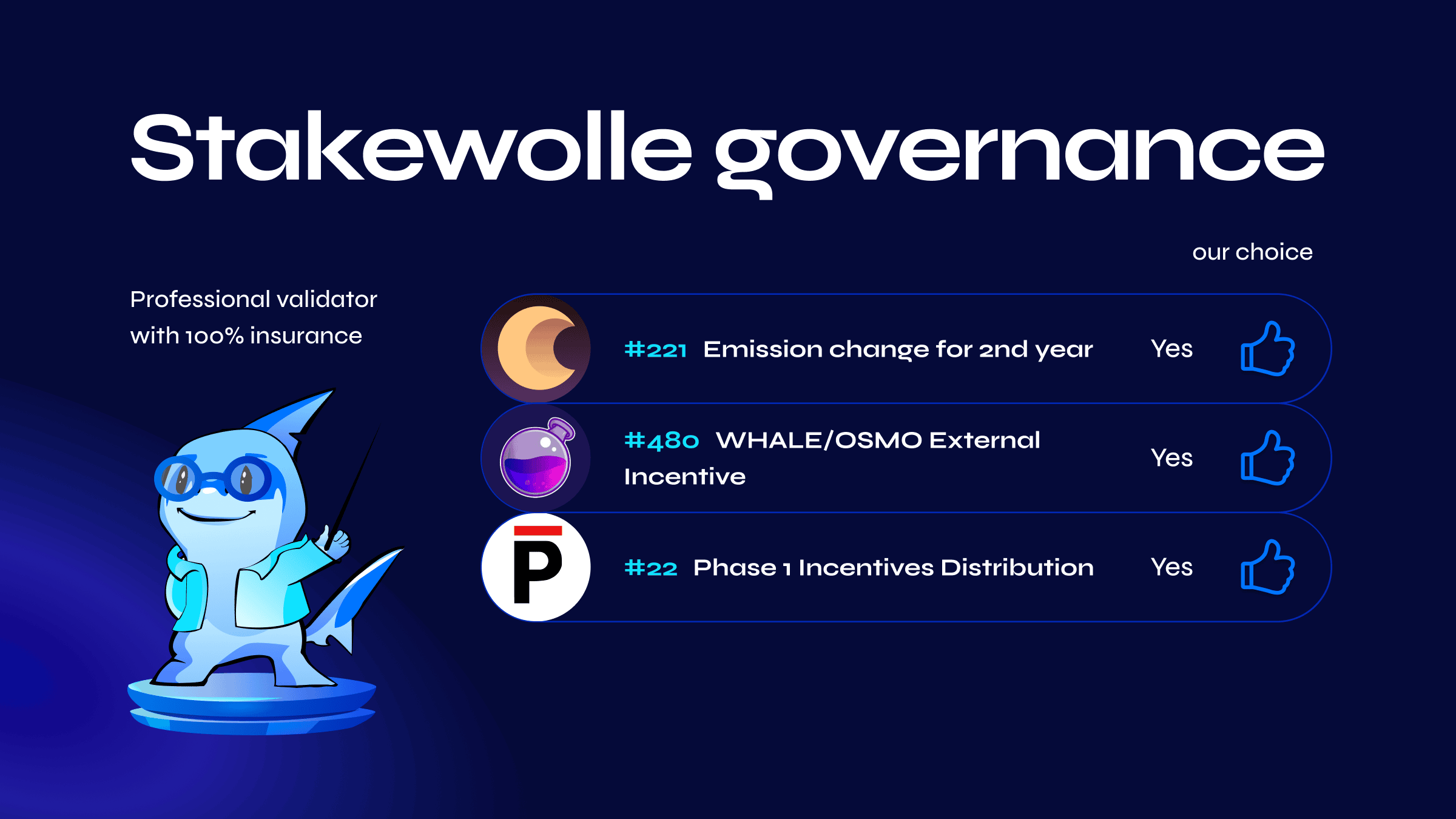

Stakewolle Governance 10.04

10 Apr 2023

1 min read

Stakewolle votes YES on Crescent Proposal#221. This proposal offers a revision of 2nd-year emissions. LP is still a large part of Crescent’s growth, and liquidity is necessary to launch new utilities. Hence LP incentives will be changed to 40%. Boostdrop will take 40%, Market Maker - 10%. With the implementation of EVM, incentives need to be allocated to 3rd party apps, and the Ecosystem Reserve will serve this purpose. 10% will be spent through governance.

Stakewolle votes YES on Osmosis proposal#480. With this proposal, Osmosis plan to match internal incentives for OSMO/WHALE pool. This would increase overall liquidity and make it easier to access any other Osmosis token.

Stakewolle votes YES on Persistance Proposal#22. We agree to allocate 166,666 XPRT to Osmosis and 333,333 XPRT to Dexter. These allocation aims to position Osmosis as the main DEX for regular assets and Dexter as the main DEX for yield-generating assets like stkATOM and stkXPRT. Incentives will strengthen Persistence’s position as The True Liquid Staking Hub.